OpenAI is preparing to introduce AI advertising in ChatGPT, despite years of public resistance from leadership. Code discovered in ChatGPT’s Android beta in late November 2025 reveals active development of an ad infrastructure, including “search ads carousel” and “bazaar content” features. Internal documents project $1 billion in ad revenue for 2026 and roughly $25 billion by 2029, signaling that advertising has shifted from “last resort” to strategic priority.

This represents a fundamental transformation for a company whose CEO once called ads “uniquely unsettling.” For business owners and advertisers, understanding this shift is essential for navigating the evolving digital landscape.

The Evidence Is Mounting

OpenAI’s journey toward advertising reveals a widening gap between public statements and internal preparations. In May 2024, Sam Altman told Harvard Business School that advertising would be a “last resort” and that he “kind of hates ads as an aesthetic choice.” By July 2025, his tone had softened considerably, and in an October 2025 interview, he acknowledged “there probably is some cool ad product we can do that is a net win to the user.”

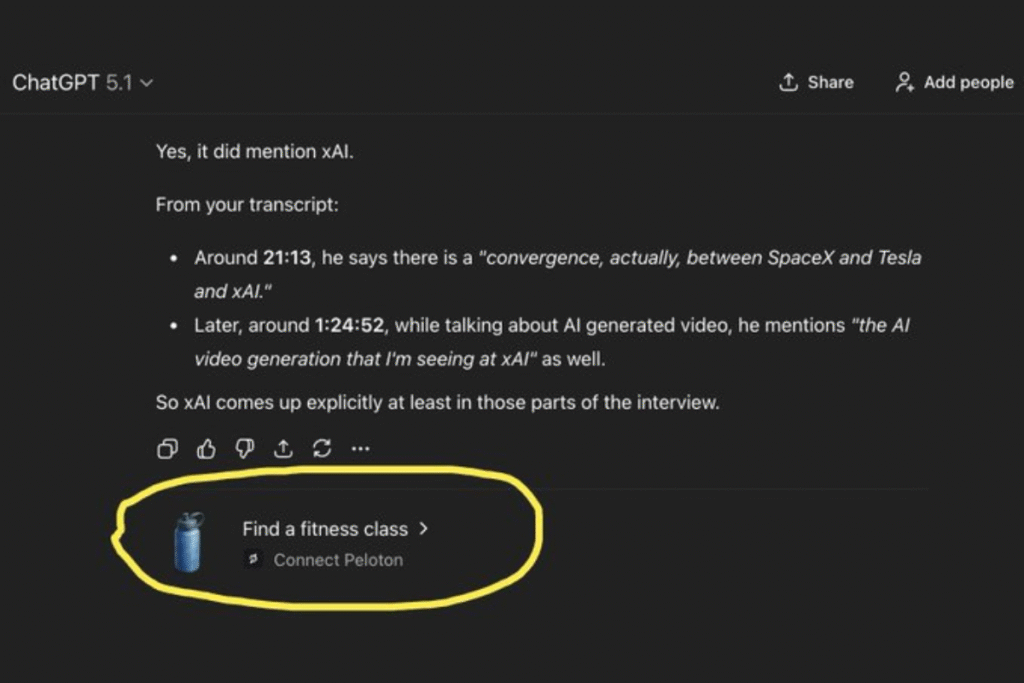

The smoking gun arrived on November 29, 2025, when developer Tibor Blaho discovered code strings in the ChatGPT Android beta version 1.2025.329 referencing an “ads feature,” “search ad,” “search ads carousel,” and “bazaar content,” the latter suggesting commerce related advertising. Days later, a ChatGPT Pro subscriber publicly shared a screenshot of what appeared to be a Peloton promotion appearing mid conversation.

OpenAI’s executive hires tell the story clearly. CFO Sarah Friar, Chief Product Officer Kevin Weil (former Instagram and Twitter/X product head), VP Shivakumar Venkataraman (former Google Search Ads executive), and CEO of Applications Fidji Simo (former Meta executive who launched ads in Facebook’s News Feed) create an executive bench with deep advertising DNA.

Why Ads Are Almost Inevitable

The financial math behind OpenAI’s advertising pivot is stark. The company is spending approximately $1.69 for every dollar of revenue generated in 2025, with cumulative losses projected at $115 billion through 2029. First half 2025 results showed $4.3 billion in revenue against roughly $7.8 billion in operating losses.

OpenAI’s current revenue model faces a structural ceiling. Of its 800 million weekly active users, only about 20 to 35 million are paid subscribers, a conversion rate of roughly 4%. ChatGPT Plus at $20 per month and the newer Pro tier at $200 per month generate substantial revenue but cannot scale to cover the costs of serving hundreds of millions of free users.

The compute commitments alone are staggering: $22.4 billion to CoreWeave through 2029, $38 billion to Amazon AWS over seven years, and billions more to Microsoft Azure and Oracle. Internal projections show OpenAI needs roughly $200 billion in annual revenue by 2030 to achieve profitability. Advertising offers something subscriptions cannot: the ability to monetize the 96% of users who will never pay.

The Competitive Landscape of AI Advertising

OpenAI is not pioneering AI advertising. It follows competitors who moved first. Perplexity AI launched its advertising program in November 2024 with “sponsored follow up questions” that appear alongside AI generated answers. The format is notably non intrusive: advertisers cannot influence actual responses, and the suggested questions are AI generated rather than written by advertisers.

Google took a more aggressive approach, rolling out ads within AI Overviews to U.S. mobile users in October 2024 and expanding to desktop in 2025. These ads appear embedded within, above, or below AI generated summaries. With 1.5 billion monthly AI Overview users and search advertising revenue exceeding $54 billion quarterly, Google’s scale advantages are formidable.

Microsoft Copilot introduced conversational ads that respond to the entire conversation context rather than just the last query, achieving 73% higher click through rates and 76% higher conversion rates than traditional search ads.

The broader market trajectory is clear. eMarketer projects U.S. AI search ad spending will surge from roughly $1.1 billion in 2025 to $26 billion by 2029, capturing 13.6% of total search advertising.

What This Means for ChatGPT Users

Based on code leaks and executive statements, ads appear focused on search and shopping queries rather than all conversations. The “search ads carousel” and “bazaar content” references suggest sponsored results in web searches and product research, similar to how Google monetizes commercial intent queries differently from informational ones.

Sam Altman has explicitly rejected pay to rank advertising: “If ChatGPT were accepting payment to put a worse hotel above a better hotel, that’s probably catastrophic for your relationship with ChatGPT.” Instead, he has floated alternatives including affiliate fees, transaction based models, and ads positioned in sidebars or footers “outside the core conversation.”

Free users will almost certainly bear the primary ad exposure. Whether paid subscribers remain entirely ad free is less specific, given that one $200 per month Pro user already reported seeing what appeared to be promotional content.

Trust concerns loom large. A Bloomreach survey found that 61% of American consumers have used AI for shopping, and many trust AI recommendations more than friends’ advice. If users begin questioning whether ChatGPT’s suggestions are genuinely optimal or influenced by advertisers, the product’s core value proposition erodes.

What This Means for Advertisers

For businesses considering ChatGPT advertising, the opportunity is compelling. ChatGPT users demonstrate high intent behavior and ask specific questions when they need solutions. Microsoft’s data showing 73% higher click through rates for conversational AI ads suggests the format may outperform traditional search. The ability to target based on the entire conversation context, combined with ChatGPT’s memory of user preferences, could enable unprecedented personalization.

OpenAI has begun courting small businesses through initiatives like the “Small Business AI Jam” partnership with SCORE, which has hosted over 1,000 small business owners across five U.S. cities. A SearchKings partnership announced in November 2025 offers SMB focused ChatGPT Team licensing.

The concern for businesses that rely on ChatGPT recommendations rather than advertising on it is the integrity of those recommendations. Altman’s stated position is unambiguous: AI output should not be modified based on payment. But the implementation details matter enormously. Will non paying businesses see their recommendations deprioritized? Will “sponsored” results appear first even when inferior? These questions remain unanswered.

How We’re Thinking About This at Growth Squad

At Growth Squad, we’ve been anticipating this moment. The introduction of advertising into AI search platforms confirms something we’ve emphasized with our clients: businesses that build genuine authority and visibility across multiple channels will be far better positioned than those relying on any single platform.

When paid placements enter the mix, organic visibility becomes even more valuable. The businesses that show up in AI recommendations because they’ve built comprehensive, well-structured digital presences will have an advantage that paid advertising alone cannot replicate. This is precisely why our approach to AI search optimization focuses on the fundamentals: consistent business information across platforms, content that directly answers customer questions, proper technical structure, and authority signals that AI systems recognize and trust.

We’re also closely monitoring whether ChatGPT advertising will be a worthwhile channel for our clients. The high-intent nature of AI conversations is promising. Still, we want to see how ad formats evolve, which targeting options emerge, and whether the economics make sense for small- to medium-sized businesses before recommending significant investment. Our role is to help clients evaluate these opportunities objectively rather than chase every new platform that emerges.

The broader lesson for SMBs is one we’ve been teaching for years: sustainable digital marketing success comes from building a strong foundation across search, content, and reputation rather than optimizing for any single algorithm or platform. When the rules change, and they always do, businesses with diversified strategies adapt more easily than those that put all their resources into one channel.

What the Experts Are Saying About AI Advertising

Industry analysts are divided between those who see advertising as inevitable and those who worry about execution risks. Some see disruptive potential, noting that if OpenAI starts showing ads in ChatGPT, it could disrupt Google’s dominance in search ads. Others emphasize the targeting advantages. Ads could be persuasive because they’re not just targeted, they’re situational, addressing needs in the exact moment users have them.

More skeptical voices warn of trust erosion, with some describing a worst-case scenario where ChatGPT becomes “a very polite, very patient, but incredibly slimy used car salesman who doesn’t take no for an answer.” User reaction to early advertising signals has been notably adverse, with some threatening to cancel subscriptions.

The Path Forward for SMBs

OpenAI’s advertising plans represent a pivotal moment in AI commercialization. The company’s financial pressures make advertising nearly inevitable despite Altman’s historical reluctance. The infrastructure is being built, the executives are in place, and internal projections already count advertising revenue as part of the path to profitability.

The key insight is not whether ChatGPT will have ads, but how well OpenAI can preserve user trust while implementing them. Perplexity’s non-intrusive approach and Altman’s explicit rejection of pay-to-rank models suggest the industry is converging on approaches that separate advertising from core AI responses. Whether this distinction holds under financial pressure will determine whether AI assistants become the next great advertising platform or cautionary tales about prioritizing monetization over user experience.

For SMBs, this shift creates both opportunities and challenges. ChatGPT advertising may offer a new high-intent channel for reaching customers. At the same time, businesses that have invested in appearing in AI recommendations may find that paid placements complicate the landscape. The companies that will thrive are those that treat AI search as one component of a diversified digital strategy rather than a standalone channel to figure out later.

We’re tracking these developments closely at Growth Squad so our clients don’t have to monitor every announcement and code leak. Our job is to translate what we learn into actionable strategies that protect and grow your digital presence through whatever comes next. The decisions OpenAI makes in the coming months about ad formats, placement, and the boundaries between organic recommendations and paid content will set precedents that ripple across the entire AI industry. We’ll be watching, analyzing, and helping our clients adapt accordingly.

If you want to discuss how these changes might affect your business or learn more about our approach to AI search optimization, we’d welcome the conversation.

Sources & Citations

The following sources were referenced in researching this article:

- Search Engine Land. “ChatGPT ads: Android code reveals OpenAI’s plans as user reports first ad.” searchengineland.com

- Gizmodo. “OpenAI’s ‘Code Red’ Crisis Memo Teases New Model and Ads in ChatGPT.” gizmodo.com

- MacRumors. “ChatGPT is Going to Start Showing You Ads.” macrumors.com

- MacRumors. “Sam Altman Declares ‘Code Red’ for ChatGPT, Delays OpenAI Advertising Plans.” macrumors.com

- Digiday. “From hatred to hiring: OpenAI’s advertising change of heart.” digiday.com

- Search Engine Land. “Sam Altman’s ChatGPT pivot: From ‘I hate ads’ to ‘maybe they don’t suck.'” searchengineland.com

- Fortune. “OpenAI says it plans to report stunning annual losses through 2028.” fortune.com

- Windows Central. “Sam Altman called ad supported AI ‘uniquely unsettling’ but new ChatGPT code suggests otherwise.” windowscentral.com

- TechCrunch. “Perplexity brings ads to its platform.” techcrunch.com

- TechCrunch. “Google brings ads to AI Overviews as it expands AI’s role in search.” techcrunch.com

- Search Engine Land. “Google starts testing ads in AI overviews.” searchengineland.com

- Microsoft Advertising. “73% higher CTRs: Why advertisers need to pay attention to conversational AI.” about.ads.microsoft.com

- Tech Monitor. “AI search ad spending in the US to hit $26bn by 2029.” techmonitor.ai

- McKinsey & Company. “New front door to the internet: Winning in the age of AI search.” mckinsey.com

- Cybernews. “What could ChatGPT ads look like?” cybernews.com

- TechCrunch. “OpenAI slammed for app suggestions that looked like ads.” techcrunch.com

- Futurism. “OpenAI Preparing to Stuff Ads Into ChatGPT, According to Beta Code in App.” futurism.com

- Search Engine Journal. “OpenAI’s Sam Altman Raises Possibility Of Ads On ChatGPT.” searchenginejournal.com

- Perplexity. “Why we’re experimenting with advertising.” perplexity.ai

- OpenAI. “Helping 1,000 small businesses build with AI.” openai.com

Article published: December 2025

© Growth Squad. All rights reserved.